I know it can’t be easy being a financial journalist in the aftermath of budget day, with so much to take in and summarise for the laity. It must be even worse for the political journos, who have to give almost instantaneous reaction on subjects which are probably not their first love: maths and finance.

A case in point was the changes to the VAT rate. So many reported the change as being 2.5%. Well, yes, in a way it was: the difference between 17.5% and 15% is 0.025 = 2.5%. However, 2.5% on 15% is actually an increase of 2.5/15 = 16.67% in the amount of VAT paid.

As if that tiresomely pedantic arithmetical issue wasn’t enough, how about when you start talking about the tax system itself?

Try this easy question: what is the top marginal rate of tax in this country?

We’re talking personal tax rates, for, say, a “typical” person of working age.

40%?

50% – the new “top rate” coming into effect in a couple of weeks?

Well, let’s have a look at the rates applicable to a typical full-time employee with one child (for 2010/11):

| Income up to |

Income Tax |

National Insurance |

Personal Allowance reduction* |

Tax Credit withdrawal* |

Total |

| £ 5,720 |

0% |

0% |

|

|

0% |

| £ 6,420 |

0% |

11% |

|

|

11% |

| £ 6,475 |

0% |

11% |

|

39% |

50% |

| £ 23,753 |

20% |

11% |

|

39% |

70% |

| £ 43,888 |

20% |

11% |

|

0% |

31% |

| £ 50,000 |

40% |

1% |

|

0% |

41% |

| £ 58,171 |

40% |

1% |

|

6.67% |

47.67% |

| £ 100,000 |

40% |

1% |

|

|

41% |

| £ 112,950 |

40% |

1% |

20% |

|

61% |

| £ 150,000 |

50% |

1% |

|

|

51% |

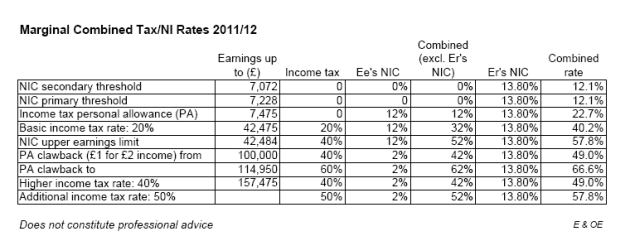

Yes, the top rate of tax for high earners after April will be 61% for those on incomes between about £100,000 and £112,950. That 98% of the late Seventies doesn’t seem so far off now does it?

Now, I doubt those in that income bracket would be regarded as poor, but have a look at someone in the £6,475 – £23,753 range: they are paying 70%, not just from next month, but for quite some time to date. So there are some people on just £125 a week forking out 70% on every extra pound they earn.

I have spared you the horrors of the implications for pension contributions for those bringing in more than £130,000, the added complexity of the 10p band (yes, it’s still there for a few lucky souls), the age-related allowances and their withdrawal rate, the special rates for dividends … come on, wake up at the back! All this, together with the dark art of the tax credit calculation, does mean that the table I threw together above could have various permutations, but the essence is the same.

So, to all the journalists out there, a helpful hint: the new top rate of tax will be 70%, not 50%, and that’s for among the lowest paid. What’s more, it has been for some time now.

* Just to explain the two less familiar columns above: tax credit withdrawal rates are essentially a tax – for every extra pound you earn, you lose 39p back to HM Treasury. The personal allowance is withdrawn at the rate of £1 for every £2 extra income, taxed at 40%; so that’s 40p out of £2: 20%. Also, I have used the 2009/10 tax credit rates – what I had to hand – so the £23,753 might change slightly in 2010/11.)

(BTW, this lot does not count as professional advice. Placing any financial or tax planning decisions on a blog post, even by an accountant, would be a silly thing to do.)

UPDATE 25/3: I’ve had a chance to check and update the figures (around the 50% rate in particular) following the budget speech, and it’s even worse – the top rate of tax is still the 70% hitting low earners. Nice one, Gordon!